China’s property market shows signs of life as new government stimulus kicks in

China’s property slump has been gruelling for investors and developers alike. Yet state stimulus measures, designed to shock the market back to life, appear to be helping

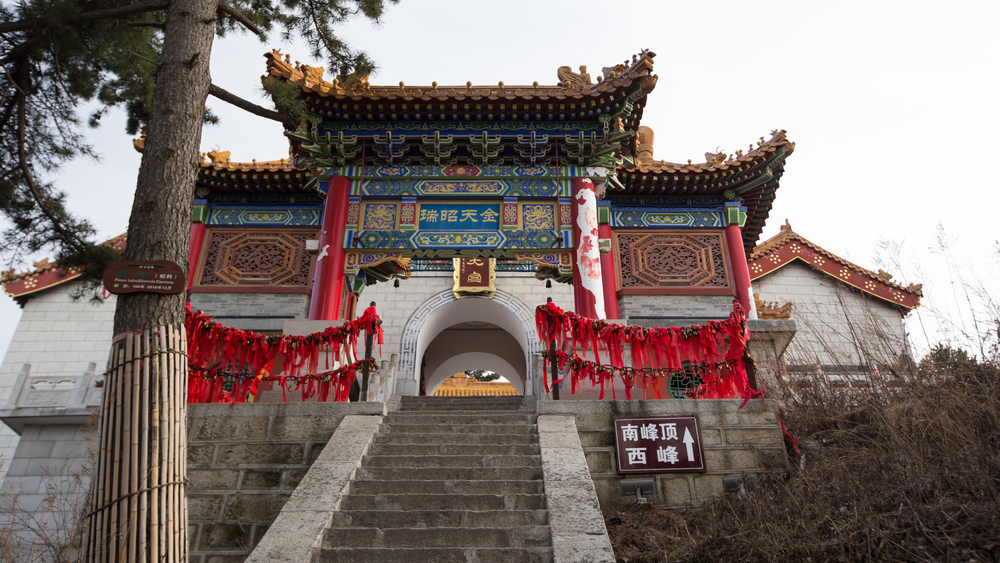

plan, a blueprint for increasing the country’s migration rate. aphotostory/Shutterstock

There were few signs of life when China’s National Bureau of Statistics reported its latest housing market data in August. New home prices in the 70 largest cities in the country were down 4.9 percent on average compared to a year earlier, their lowest in nine years.

This was the 13th month in a row that prices had fallen. However, there were also signs, however small, that an end to the ongoing housing crisis may finally be in sight. Although prices fell again in July, this was at the same rate as in June, indicating the runaway train demise of the Chinese housing market may be coming to a halt.

A few green shoots have started to appear among the red numbers in the data and wrecked confidence that has typified recent doom and gloom around the Chinese market. Shanghai registered an uptick in prices of 0.2 percent in July versus the previous month, as did Xi’an in central China.

Prices in Taiyuan and Jilin in the north of the country remained unchanged. Of 70 of the country’s cities, four had seen prices stabilise in July. Following months of house price declines, corporate defaults at the country’s biggest developers, and talk of a housing crisis that seemingly never ends, these may be the first signs that the respite is in sight. Is there finally cause for cautious optimism, or is it yet another false dawn?

Support from Beijing has helped create more positive conditions. In mid-May, the Chinese government unveiled drastic measures to halt the market slide. The People’s Bank of China announced a rescue package whereby RMB300 billion (USD41.5 billion) would be mobilised to buy up unsold housing stock.

Explaining the new policy, Vice Premier He Lifeng instructed city governments to convert excess inventory to affordable housing, which would both funnel much-needed income to the industry’s struggling developers and offer cheaper housing to lower-income families.

Not since a decade earlier, in 2014, had the Chinese government implemented such “drastic market stimulation measures”, says James Woo, executive director and cohead of valuation and advisory services at Colliers China, in Beijing.

Overall, the 2024 stimulus appears more expansive compared to 2014, potentially signalling the government’s intent to provide greater support to the real estate market

Additional measures designed to shock the market back to life, after years of curbs on runaway prices, have also been introduced, adds Woo. Downpayments on properties, reduced to between 20-30 percent for first and second homes in 2014, are currently lower at 15-25 percent, he says.

Mortgage lower limits have also been reduced. In 2014, this rate minimum stood at 3.43 percent; in 2024, the bottom end has been removed entirely except for in Beijing, Shanghai, and Shenzhen at between just 3.05-3.15 percent.

“Overall, the 2024 stimulus appears more expansive compared to 2014, potentially signalling the government’s intent to provide greater support to the real estate market,” says Woo.

In a less noticed move by the Chinese government, in late July, the State Council released its five-year urbanisation plan, a blueprint for increasing the country’s migration rate from rural areas with the aim that 70 percent of the population would live in cities by the end of the decade.

Although designed principally to raise disposable incomes and encourage consumption, the plan will increase demand for housing in cities in the medium term, says David Zhang, an analyst at the China-focused consultancy Trivium.

“Urbanisation is a drawn-out process and won’t reverse China’s ongoing property slump anytime soon,” comments Zhang. “The hope is that, in the long run, a constant stream of new urbanites can support the property sector’s transition towards a stable and healthy growth model.”

Confidence in the housing market and the wider economy remains “shaky”, adds Zhang, and is a key factor as the government and private sector seek out solutions to turn the market around. Following years in which prices kept rising, and ordinary Chinese buyers believed the upward trend would never end, suddenly the largest asset most of the population will ever own has fallen in value and continued to do so for more than a year, an unprecedented situation for many.

Continued distress among the largest developers in the country, the catalyst for the ongoing crisis, hasn’t helped. In late August, developers Sunac and Vanke forecasted half-year losses of RMB15billlion (USD2.1billion), and RMB7billion (USD980m), respectively. Combined half-year losses at 10 Hong Kong-listed developers, among China’s largest including Sunac and Vanke, were expected to reach between RMB51.38billion and RMB57.88billion, about the same levels as a year earlier, according to Nikkei Asia.

Amid the search for newfound market confidence, Chinese government officials and the Party press have attempted to push a positive narrative, particularly around the recent stimulus measures. In early July, the nationalist Global Times reported signs of a market “uptick amid policy supports”, and a week later a similar opinion piece was printed in the same newspaper.

Analysts meanwhile have remained more cautious as the wait for the end of China’s housing market slump continues. Following the release of the latest housing price data in mid-August, analysts at the Dutch investment bank ING say the market “will continue to need more policy support to establish bottom” in a research note to investors.

“Data has shown that there is still a lack of confidence and demand in the property sector,” says Woo of Colliers. “A recovery sign is difficult to see in the short term.”

The best outcome in the near term remains market stabilisation, in terms of house prices and sales volumes that can help the industry undergo “consolidation and rebalancing”, according to James Macdonald, head of Savills Research China, in Shanghai.

Although the measures introduced by Beijing in May prompted an initial boost in sales the same month and in June, “momentum appears to be waning” before in turn “suggesting that the impact may be limited or temporary”, he says.

A key part of the problems facing the Chinese market remains wider issues around the overall economy and sluggish growth. Although the Chinese government has set an economic growth target of five percent for this year, many analysts have remained cautious it can still be achieved, despite reaching 5.2 percent last year. In the second quarter, official data showed a rate of just 4.7 percent.

“Expectations for a significant rebound remain cautious,” says Macdonald of Savills. “Beyond targeted property market policies, a broader recovery will require improvements in the overall economic outlook, including factors such as job growth and wage increases, before we can anticipate a more robust recovery in the property sector.”

The original version of this article appeared in PropertyGuru Property Report Magazine Issue No. 186 on issuu and Magzter. Write to our editors at [email protected].

Recommended

Meet the architect transforming Asia’s retail spaces with nature-inspired designs

David Buffonge, the cofounder of Hong Kong-based Lead8, has strong opinions on how to improve built environments around Asia

ARES White Paper Volume 3: The era of adaptive reinvention

Pioneering sustainable and innovative practices in urban development

ARES White Paper Volume 2: Unravelling the power of data revolution in real estate

Insights on proptech, smart cities, and sustainable development

ARES Digital White Paper Volume 1: The fundamentals of responsible building

Green and climate heroes join forces to discuss how Asia Pacific can weather the current environmental crises and the looming effects of climate change