The EV boom is revving up Southeast Asia’s real estate market, but what about homes?

The global EV boom is fuelling industrial real estate sectors around Southeast Asia, but there’s been negligible impact so far on the region’s residential markets

Thailand’s potential as a hub for electric vehicle (EV) production got a huge boost when Elon Musk met Thai Prime Minister Srettha Thavisin in New York last year.

It emerged that Thailand had been shortlisted as a possible site for a new Tesla factory. Follow-up meetings with Tesla executives were later held in Bangkok. As yet, though, a Tesla Thailand factory has not materialised.

Tesla told the Thai government a huge 320-hectare site would be required, larger than most industrial estates in the country. “City planning doesn’t support that,” the Thai government said.

Meanwhile, BYD, the Shenzhen-based EV giant, went ahead with construction on a new Thailand factory in March at a much smaller 96-hectare site. Already the number-one EV seller in Thailand, BYD plans to roll out 150,000 units per year from the new facility following the start of trial production this year.

With Singapore set to cease all new combustion engine vehicle sales by 2030, and Thailand, Vietnam, and Indonesia moving towards similar deadlines in 2035, 2040, and 2050, respectively, ASEAN has become a key battleground in the global EV industry. Thus far, fast-moving Chinese companies are the clear winners, driving changes in real estate dynamics across the region.

In Thailand, the top two brands by sales in 2023—BYD and Neta—were Chinese, the former outselling Tesla, which placed fourth, more than three times over, according to official data.

By the end of last year, Thailand’s Board of Investment (BOI) had approved at least 26 EV-related projects, according to an analysis by law firm Baker-McKenzie. In April, Chery announced plans for a new factory in Rayong, becoming the eighth Chinese EV company to set up in Thailand.

“The BOI is committed to the government’s policy of making Thailand a manufacturing hub of EVS in the region,” said BOI Secretary-General Narit Therdsteerasukdi following Geely’s announcement.

Indonesia is also establishing itself as a regional EV hub. Last year, multinational real estate agency Colliers said the EV sector would take “centre stage” as the country’s industrial real estate industry looks to emerge as a key ASEAN destination for global high-tech investment. BYD announced plans for a new 100-hectare factory in Subang, West Java in May, with construction due to start this year, and operations scheduled for early 2026, according to a company announcement. Of BYD’s five overseas production bases, two— Thailand and Indonesia—will be in ASEAN.

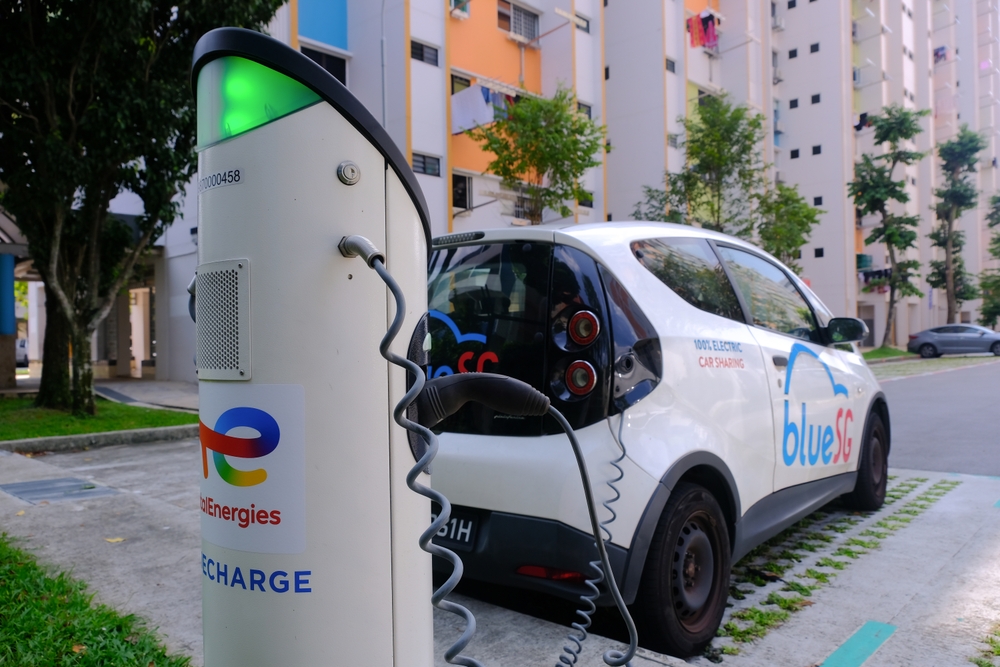

A key regional market for BYD and other Chinese EV makers, Singapore is set to be the first country in the region to ban combustion engine sales with a target date of 2030. Complications remain, however. Critics of Singapore’s ambitious EV plans have lamented the slow roll-out of charging points in public spaces and commercial buildings, so too the still high cost of EVs in the city-state.

ASEAN has become a key battleground in the global EV industry. And fast-moving Chinese companies are the clear winners at this stage

“There seems to be this feeling building up that the EV dateline could be extended,” says Alan Cheong, executive director of research and consultancy at Savills Singapore. “Already, there are questions about the viability of mass-scale adoption of EVs in developed countries. So long as there are nagging questions and alternative methods to powering vehicles, it would sow doubts whether it is wise to follow that 2030 timeline.”

Although EV unit sales in Singapore surged more than 50 percent, according to Land Transport Authority data, the base remains low with just 18 percent of new vehicle registrations in the EV class. Price remains a key issue. Last year, the most affordable EV on the market in Singapore was BYD’s Dolphin priced at SGD159,888 (USD118,400), although other low-cost Chinese car-makers Zeekr and Xpeng were due to begin EV sales later this year.

These uncertainties have played into residential market considerations when it comes to EV adoption and installing power points for vehicles, according to Cheong of Savills. Still, few buyers are demanding EV charging points, he says. “There has been some uptick in inquiries but it is not moving the needle,” he says. “Whether for investors or owner-occupiers, they don’t specifically ask about EV infrastructure.”

In Vietnam, another fast-emerging EV sales and production market in the region, charging points have recently become a sales negative. In September last year, a fire at an apartment building in Hanoi led to the deaths of 56 people, the deadliest such incident in the country in more than a decade.

Rumours started that the blaze was caused by an EV charging station. Although police denied a charging point had led to the fire, word spread, leading to some building owners in Hanoi banning EV charging at their properties.

Even so, Vietnam remains among the most dynamic EV markets in ASEAN, given the strong presence of homegrown brand VinFast which in early 2024 began sales in the US, one of 50 countries in its rapidly expanding portfolio. In July, BYD was set to ramp up local competition in the sector by introducing three of its models into Vietnam for the first time.

Yet VinFast remains the dominant local market player, and in turn, looks set to challenge Chinese EV makers in the ASEAN region. In May, VinFast began EV sales in the Philippines, and in June, the company announced it would start production at a new facility in Indonesia by late 2025, further driving local demand for industrial real estate space in ASEAN’s most populous nation.

“We expect to break ground on our manufacturing facility in Indonesia within the next two months,” the company said in a filing to the market regulator in New York, announcing a host of new regional market moves. “[This new factory has] a potential ramp-up of up to 300,000 vehicles per year, depending on market demand.”

The original version of this article appeared in PropertyGuru Property Report Magazine Issue No. 185 on issuu and Magzter. Write to our editors at [email protected].

Recommended

How air pollution is driving a real estate transformation in Chiang Mai

Thailand’s persistent problems with polluted air are prompting calls for tougher government action

ARES White Paper Volume 3: The era of adaptive reinvention

Pioneering sustainable and innovative practices in urban development

ARES White Paper Volume 2: Unravelling the power of data revolution in real estate

Insights on proptech, smart cities, and sustainable development

ARES Digital White Paper Volume 1: The fundamentals of responsible building

Green and climate heroes join forces to discuss how Asia Pacific can weather the current environmental crises and the looming effects of climate change